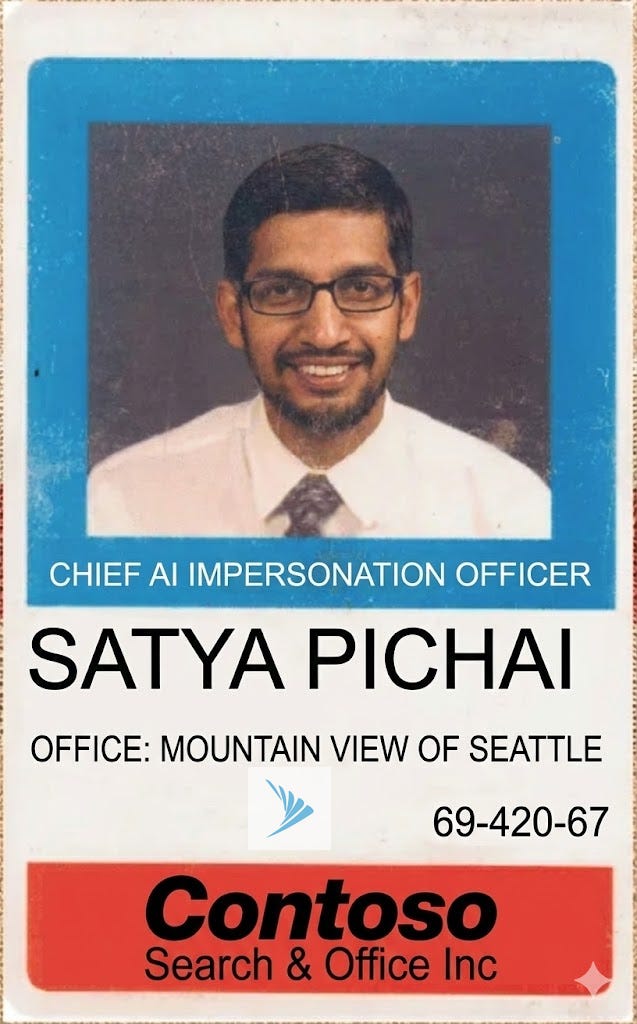

AI can forge your badge—and your Aadhaar/PAN. Here’s how Entra Verified ID helps (Workforce + Banking CIAM)

When badges and documents can be faked on demand, trust must be cryptographic—not cosmetic.

A person recently claimed they printed a convincing company ID card using an AI tool (“Nano Banana Pro”), walked into a company premises, had lunch in the cafeteria, and casually spoke with employees. Whether the story is fully accurate or partly exaggerated, it’s a believable scenario in 2025—because visual trust (plastic cards, PDFs, screenshots) is now easy to counterfeit.

Now extend that same fraud pattern to financial services: imagine a forger creates a fake Aadhaar card and PAN card using the same AI approach and shows up at a premier bank branch in Mumbai requesting bank statements or account-related services. It’s a long shot, sure—but it’s exactly how modern identity fraud works: one successful impersonation can be enough.

The common thread across both stories is simple:

If your security depends on someone eyeballing “documents,” AI has already changed the game.

What we need now is not “better looking IDs,” but verifiable proof.

Case Study 1: The AI-printed company ID that gets someone inside

What happened (the plausible version)

A forged badge is printed with a credible logo, fonts, employee photo, and QR code.

At the gate, the guard does a quick visual check.

During a busy lunch hour, cafeteria staff assume legitimacy (“looks like staff”).

The person blends in, chats with employees, and leaves with social proof and inside context.

What actually failed

Static identity artifacts were mistaken for proof.

There was no real-time check for:

“Is this person currently employed?”

“Is their access valid for this building today?”

“Has this credential been revoked?”

A printed badge is an image. AI can generate images endlessly.

Case Study 2: Fake Aadhaar + PAN to request sensitive bank services

The (long-shot but real) risk scenario

A forger creates counterfeit Aadhaar and PAN documents and presents them at a branch.

They request:

bank statements,

address/phone updates,

a replacement debit card,

account details “because I lost my phone,” etc.

Even if the bank has controls, the weak point is the same: paper / PDF identity checks are still largely visual and process-driven. AI doesn’t need to beat cryptography—it only needs to beat a rushed human workflow once.

What actually fails in these attacks

Documents are treated as truth instead of verifiable claims

Bank staff must decide under pressure:

“Do these documents look real?”

“Does this person seem like the account holder?”

That’s not a security model—it’s a judgment call.

The fix: Stop trusting artifacts. Start verifying proofs.

What is Entra Verified ID (in one line)?

Microsoft Entra Verified ID enables organizations to issue and verify cryptographically signed digital credentials (Verifiable Credentials) that are:

tamper-resistant,

privacy-preserving (share only what’s needed),

time-bound,

and revocable.

Think of it as upgrading from “a printed card” to “a digitally signed proof.”

How Entra Verified ID prevents the fake company badge scenario (Workforce)

The modern workforce entry check

Instead of relying on a printed badge, the entry point verifies a digital credential:

Company issues an “Employee Credential” (Verified ID) to the employee’s wallet.

At the gate/cafeteria/secure zone, employee presents a QR-based proof.

Verifier confirms, in seconds:

issued by your organization,

valid today (not expired),

not revoked (leaver/termination handled instantly),

correct access level (HQ vs. engineering center vs. visitor).

Why this works against AI

AI can forge:

photos, badges, QR images, names, role titles.

AI cannot forge:

a valid cryptographic signature from your tenant’s credential issuer.

Printed badge? Optional. Verifiable proof? Mandatory.

How banks can use Entra Verified ID for customers (CIAM + branch + service proof)

This is the key shift for banking:

Don’t only ask “Who are you?”

Also ask “Are you a verified customer entitled to this request?”

Use case: “Proof of Bank Customer” credential

A bank can issue a Verified ID credential such as:

Bank Customer Credential (or “Account Holder Proof”)

claims could include (minimal disclosure):

customer = true,

last-4 digits of customer ID,

account relationship status (active),

KYC completed = true,

risk tier / branch mapping (optional),

credential expiry date.

When a person requests sensitive services (e.g., bank statements), the bank verifies:

the credential is real (signed by the bank),

belongs to the presenter (wallet possession / proof),

is still valid (revocation checks),

and matches policy (service allowed at this level).

Why this helps even if Aadhaar/PAN are forged

If someone walks in with fake documents but cannot present a valid “Bank Customer” verified credential, the branch treats the request as high risk, and routes them into enhanced verification.

This reduces fraud while improving legitimate customer experience.

Where Government ID verification fits (and how to use it safely)

Government IDs can still be useful—but as onboarding/identity proofing, not as the only gate at service time.

A practical model:

During KYC / onboarding, the bank conducts government ID verification (document + selfie + liveness, per bank’s workflow).

Once verified, the bank issues the Bank Customer Verified ID credential.

After that, most routine high-risk requests can be satisfied by verifying the credential + step-up checks (OTP, device binding, branch biometrics, etc., per policy).

Outcome: government ID becomes an input into credential issuance, not a repeatedly photocopied artifact.

Putting both case studies together: one pattern, two domains

In workplaces:

“Are you a valid employee/contractor right now?”

“Are you authorized for this premises/zone?”

In banking:

“Are you a verified customer of this bank?”

“Are you entitled to request this sensitive service in this context?”

Both are solved by the same upgrade:

From: documents and badges (easy to fake)

To: signed, verifiable, revocable credentials (hard to fake, easy to validate)

A realistic rollout plan (what to recommend)

Phase 1 — High-impact, low-friction

Workforce: Employee + Contractor credentials, gate verification pilot.

Banking: “Proof of Customer” credential for branch-led sensitive requests (statements, profile changes, replacement cards).

Phase 2 — Step-up and policy hardening

Add risk-based policies:

If credential missing → step-up flow.

If credential revoked/expired → deny.

If unusual branch/location/time → step-up.

Integrate with lifecycle:

HR events revoke workforce credentials instantly.

Core banking events revoke customer credentials when relationship ends.

Phase 3 — Expand to ecosystem

Visitors, partners, vendors (time-bound access credentials).

Banking partners / RM workflows.

Digital channels (CIAM sign-in + credential-based entitlement).

Call to action: Bring proof-based identity to your workforce and your customers

AI is not just generating content anymore—it’s generating convincing identity artifacts. The defense is not “better printing” or “more training alone.” It’s verifiable proof that can be validated instantly and revoked immediately.

Digital Proton helps organizations design and deploy Microsoft Entra Verified ID solutions across:

Workforce Identity (WAM): Employees, contractors, vendors, facility access, entitlement verification

Customer Identity (CIAM): Proof-of-customer credentials, branch/service verification, risk-based step-up, lifecycle governance

If you want to reduce impersonation risk while improving user experience, reach out to Digital Proton to discuss:

your two highest-risk identity journeys (physical entry + sensitive service requests),

a quick pilot using Entra Verified ID,

and a roadmap that aligns security, compliance, and operations.

Let’s replace “looks legit” with “proves legit.”